Consider the Price of the Vehicle You’re Buying

Consider the Price of the Vehicle You’re Buying

When choosing a vehicle, consider the price. Not only do you want a car that’s priced fairly, but you also want one that’s affordable for you. That means not just the overall cost, but how much the payments will be, as well. By selecting a car that’s a good value and has a moderate price point, you’re more likely to get a loan even when your credit isn’t the best.

That’s because the lender will see that the car is worth what you want to borrow, making it strong collateral for the loan. It’s also because you’re showing that you’re looking for a safe, reliable, useful car, not stretching your budget unnecessarily to purchase a sports car or luxury vehicle. There’s no rule against sports cars or luxury cars when you’re purchasing a vehicle with a low credit score, but it may be more difficult to qualify.

Make Sure You Clean Up Your Credit

Make Sure You Clean Up Your Credit

If you’re really focused on how to get a car loan with low credit score issues, you’ll want to improve your score as much as possible first. Even a few points difference in your credit score could make the difference between qualifying for a loan or being denied. You don’t want to let that be the deciding factor when you shop for a vehicle and ask for financing.

Have Your Current Finances in Order

Have Your Current Finances in Order

Besides a down payment that’s bigger, the income you have will also matter. You need to repay your loan and the easier that will be for you the more likely you are to be approved. If you’ve recently gotten a higher-paying job or a strong promotion, make sure you have proof of that. A lender will look at your circumstances and whether there are any large changes to your recent financial picture before making a determination.

If you have something significant to show them, it could be the difference in whether you’re approved for a loan. There’s no guarantee that a bigger down payment or higher-paying job will mean approval. But you have a better chance when your finances are on the upswing and you can prove it. Depending on the reason for your lower credit score, a lender may work with you despite prior financial concerns.

Work With a Lender You Can Trust

Work With a Lender You Can Trust

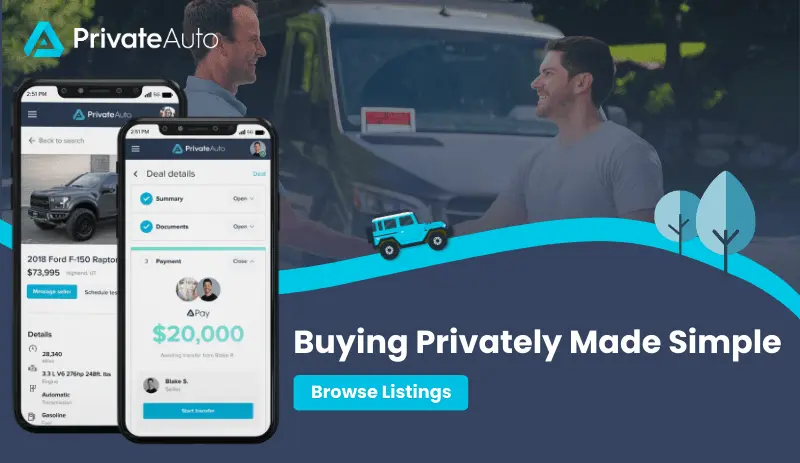

With PrivateAuto, getting a vehicle loan with a lower credit score is going to be easier than ever. Now functionality is streamlining the process and giving you and other buyers the chance to handle everything in one place. The new financing feature is coming soon to PrivateAuto, and will directly integrate buyer financing in the app.

That way you don’t need to work with a third-party bank to get a loan. Instead, PrivateAuto has a financial institution that they partner with to make the process faster, smoother, and easier. People who want car loans but are concerned about their credit scores will find out what they can borrow and shop for a vehicle all in one place. Then they can complete the sale online and enjoy their great new vehicle.

Find Your New Ride and Loan With PrivateAuto Today

Find Your New Ride and Loan With PrivateAuto Today