The Importance of Transferring Insurance

Transferring insurance from your old car to the new one isn’t just a matter of convenience. It’s a legal necessity in many jurisdictions. It represents a critical step in the process of changing cars.

Imagine the chaos if your recent car’s new owner gets in an accident with your name still on the policy. You could be on the hook financially. Maybe even legally.

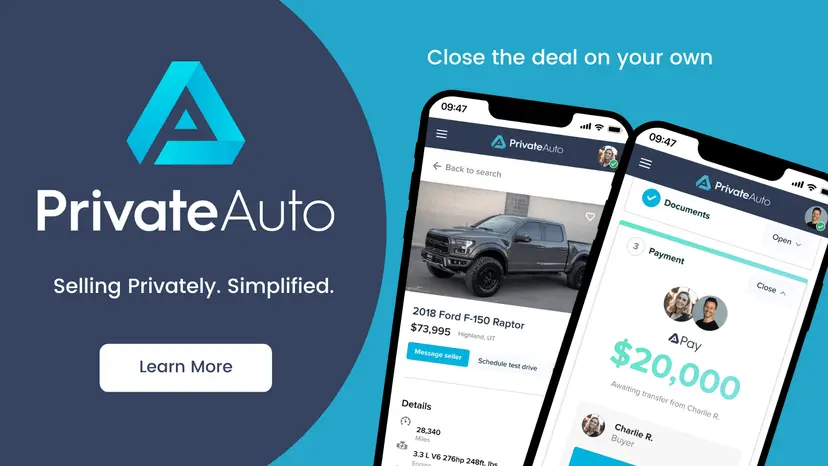

If you decide to look into getting new insurance instead of transferring your existing policy, you can get insurance quotes and apply for car insurance coverage right within the PrivateAuto app—super easy if you’re already using PrivateAuto to buy or sell a car.

Transfer or cancel?

Transfer or Cancel Insurance?

You might be tempted to cancel your insurance policy and start afresh, but transferring it could be the smarter choice.

What is continuity of coverage?

Continuity of Coverage

Transferring your policy ensures uninterrupted coverage. No gap could leave you unprotected or legally exposed. From the old car to the new, the coverage flows smoothly, and this seamless transition might be crucial if there are any unforeseen incidents.

Preserving Your Insurance History

Insurance companies often value long-term, continuous relationships. Transferring the policy keeps your insurance history intact, potentially leading to loyalty discounts or more favorable terms. A stable history can signal reliability and might impact your premiums positively.

Tailoring to Your New Car’s Needs

Transferring doesn’t mean merely shifting the same policy from one car to another. It’s an opportunity to tailor and adjust the coverage to your new vehicle’s specifications. Need different coverage levels or additional features? A transfer can accommodate these changes without starting from scratch.

How to avoid cancellation fees?

Avoid Cancellation Fees

Cancellation might come with fees or penalties, depending on your policy’s terms. Transferring avoids these costs, making it a financially prudent decision.

Ease and Convenience

An insurance transfer can be a more straightforward process, without the need to navigate the maze of starting a new policy. The existing relationship with your insurer can make the transition smoother and less time-consuming.

What is the insurance transfer process?

How to Transfer Car Insurance

Transferring car insurance from your sold vehicle to your new-to-you one isn’t merely a wise decision; it’s a process that needs to be done step by step.

1. Notify Your Insurance Provider

As soon as you decide to sell your old car and buy a new one, inform your insurance company. Early communication can ensure a smoother transition.

2. Provide Necessary Information

Your insurer will need specifics about the new vehicle, such as make, model, Vehicle Identification Number (VIN), purchase date, and any modifications.

3. Discuss Coverage Needs

Start by analyzing your existing coverage to see how it aligns with the new car’s requirements. Consider what you already have and what might need adjustment.

Different cars have distinct needs. You may need to add comprehensive coverage, increase liability limits, or include special coverage.

4. Review Costs

Your transferred policy could end up costing more, the same, or less than it did before the transfer. Adding more coverage might raise costs, while removing features could reduce expenses. Different years, makes, models, and styles can also adjust premiums up or down.

5. Complete the Paperwork

Your provider will guide you through the required paperwork. Complete it diligently, ensuring all details are accurate.

What are common mistakes to avoid?

Common Mistakes to Avoid in Insurance Transfer

Don’t make any of the following mistakes. They’re fairly common, but also very avoidable. Be smart and handle the transfer properly, and you won’t run into problems.

Delaying Notification to Your Insurance Company

Any delay in transferring your policy can create complications, especially if an incident occurs during this transitional period. Notify your insurer as soon as possible to ensure a smooth transfer process.

Ignoring Your New Car’s Specific Requirements

Transferring a policy without tailoring it to your new car’s specific needs can lead to inadequate or excessive coverage. Review the new car’s requirements and discuss with your provider how your coverage might need to change.

Not Understanding Cancellation Policies and Fees

If considering cancellation instead of transfer, a lack of understanding of potential fees or penalties can be costly. Carefully read your policy or consult with your insurer about any fees that might apply to cancellation.

Neglecting State-Specific Regulations

Different jurisdictions may have unique requirements, and overlooking these can lead to legal complications. Research and comply with the specific regulations in your area or consult with a local expert.

Handle Your Insurance Transfer Right

Transferring insurance from a car you’re selling to a car you’re about to buy can be a simple process if you know what to do. By following the tips in this article, you can make sure that your insurance coverage is transferred smoothly and that you have the right coverage in place for your new car.

Sell or Buy a Vehicle Online With PrivateAuto

We are the only transactional marketplace where you can sell or buy a car easily and conveniently.

Shop used vehicles for sale by owner and get your dream car today!

Our innovative platform connects buyers and sellers and gives them all the tools to complete the deal, from in-app car financing to secure messaging to integrated payments via our banking gateway, PrivateAuto Pay. You can also schedule a test drive and negotiate the price without ever disclosing your personal information.

Here are the steps to selling your car on PrivateAuto.

- Gather the required paperwork for selling a vehicle

- Register on PrivateAuto and get verified

- List your car

- Set your terms

- Vet incoming offers

- Choose a buyer

- Schedule a meeting

- E-sign the bill of sale

- Get paid, instantly

- Transfer vehicle title

Insurance FAQ

How long does it take to transfer car insurance?

It typically takes 1-2 weeks to transfer car insurance. However, the exact time may vary depending on your insurance company.

Where is the best place to shop for car insurance?

There are many resources where you can get quotes for auto insurance and compare providers. For example:

– Sites such as Assurance IQ offer a quick comparison of policies from available providers.

– PrivateAuto allows you to compare providers and get a policy without ever leaving the PrivateAuto app (super convenient!).

– Your existing insurance provider (home, life, or other types of insurance) may be able to provide you with competitive rates.

What happens if I don't transfer my car insurance?

If you don’t transfer your car insurance after selling your car, you could be at risk in several ways:

– You may not be covered in the event of an accident. This is the biggest risk of not transferring your car insurance. If you get into an accident while driving your old car, your insurance company may not cover the damages. This could leave you responsible for paying for the damages out of your own pocket, which could be very expensive.

– You could be charged for non-payment of premiums. If you don’t transfer your car insurance, you’ll still be responsible for paying the premiums. If you don’t pay the premiums, your insurance company could cancel your policy and you could be charged for non-payment.

– You could be sued. If you get into an accident while driving your old car and you’re not covered by insurance, the other driver could sue you for the damages. This could result in a financial loss for you.

– Your credit score could be affected. If you don’t pay your car insurance premiums, it could affect your credit score. This could make it more difficult to get a loan or credit card in the future.

– You could lose your driver’s license. In some states, you could lose your driver’s license if you don’t have car insurance.

Can I transfer my car insurance to a different company?

Yes, you can transfer your car insurance to a different company. However, you may need to provide proof of insurance from your old company.

What if I have a loan on my car?

If you have a loan on your car, your lender may require you to have certain levels of insurance. You should check with your lender to see what their requirements are.

Do I need to change my insurance if I get a new car?

You may need to change your insurance coverage if you get a new car. This is because the coverage for your old car may not be appropriate for your new car.

What if I'm selling my car but still have insurance on it?

If you’re selling your car but still have insurance on it, you can usually transfer the policy to another vehicle or cancel it. However, you may have to pay a cancellation fee if you opt for this option.

How much does it cost to transfer car insurance?

The cost of transferring car insurance varies depending on your insurance company and the type of coverage you have. However, it’s usually a relatively inexpensive process.