Advantages to Selling Your Car Fast

You get your money sooner

Selling your car quickly is a great way to catch up on bills during financial hardship or to upgrade your car without forking out all your savings. If you can no longer afford payments on your vehicle, selling it can be an easy way to pay off the debt and cut your losses.

Less depreciation

Depreciation rates vary considerably by vehicle type, but one thing’s certain, every vehicle’s value falls by a certain percentage each year. A car’s value drops a few thousand in the time it takes to pull off the dealer’s lot!

Carfax explains, a car’s value typically decreases, “more than 20 percent after the first 12 months of ownership. Then, for the next four years, you can expect your car to lose roughly 10 percent of its value annually.” After 10 years, a car is usually only worth 10% of the price you paid when it was new.

You can drop the insurance coverage

You don’t have to devote as much time

The actual time frame can differ substantially, and often hinges on the flexibility of your price and the type of vehicle you’re selling. The area in which you live also plays a factor. For instance, the demand for soft-top vehicles is low in rainy climates like Washington but are very popular in warm-weather states like California.

You don’t have to pay taxes on the car

Sell it to a Dealership

The great thing about dealerships is they normally handle all the paperwork for you—all you have to do is sign and hand over the keys. A dealership won’t waste your time either, they’ll normally tell you off the bat whether or not they’re interested. You’re also less likely to be scammed when going through an accredited business rather than an individual.

Now for the not-so-great-news. Due to their profit margins, dealerships will offer you much less than a private buyer—and even less for a trade-in. A fair dealer will generally offer around 75%-79% of the car’s Kelley Blue Book value, even less if it needs repairs. Used car dealers may spend up to $500 just detailing the car before moving it to the lot.

Try haggling or go to a different dealership if you think the dealer isn’t offering you a decent price. It never hurts to shop around, especially if it means you’ll get more elsewhere.

If you’re still making payments or have a vehicle lien you won’t be able to sell it to a dealership until it’s paid and you have the title in-hand. Expect it to take around 10 days to receive your lien release and up to 30 days for a paper title if filed by mail.

Sell it Yourself

Online marketplaces like Facebook or craigslist will expand your customer base and increase the likelihood of finding a buyer quickly. One downside to this is it can be annoying. Be prepared to haggle and know you’ll still receive responses during non-waking hours.

Be on the lookout for scammers, while Craigslist and Facebook do their best to eliminate these users, some find a way to slip through the cracks. For more information, check out this article on how to spot common Craigslist scams.

Selling your car privately is time-consuming, even if you manage to find a serious buyer early on. You’ll still have to get the car ready for sale, locate your title, arrange meet-ups, draft sales documents, and fill out paperwork at the DMV and county tax office to finalize the transaction.

Sell It to Someone You Know

An acquaintance may expect you to give them special treatment, like requesting a “friendship discount” or to pay in installments. When selling a car to a friend, it’s important to remember that it could cost you your friendship if the transaction goes bad.

Make sure your friend knows you aren’t responsible for any mechanical issues that may arise after the deal’s done. It may be a good idea to include this in writing on the bill of sale. With that being said, you should be honest about any existing issues or accidents that the car has been in. Being honest in the beginning can spare you from a lot of hassle and back-peddling later.

A Warning About Installment Plans

Consider asking a lawyer to write up the paperwork for you rather than doing it yourself. A professional will ensure the contract will be upheld in court should an issue arise. The average attorney cost to draw up a contract is upwards of $300. Although pricey in the short-term, it’ll serve as an insurance policy if the buyer can’t make the payments.

If you must draft the contract yourself, be sure you follow a template (like this) and write out the payment schedule in the document. Both you and the buyer will need to sign the contract in the presence of a notary, who will also sign and stamp the document to make it legal.

Use a Car Buying Service

This emerging industry is the newest channel for buying or selling a car without ever leaving your rolly chair. Most of these companies will even pick up your old car and deliver it right to the buyer’s doorstep.

For sellers, Carvana is a pretty solid option. They’ll factor their offer by taking the KBB value and adding or subtracting the adjusted market value of your vehicle type in your area. Their offer will also take into consideration the physical condition of your car by running a vehicle history report and asking a series of questions like if the vehicle has been smoked in or experienced hail damage.

Accredited car buying services like Carvana do seem to be much safer and more convenient than dealing with strangers from craigslist, especially if you arrange for “hands-free pickup” at one of their vending machine sites.

So what’s the catch?

Secondly, Carvana won’t buy your vehicle if it was manufactured before 1992, has mechanical problems with the odometer, or if it doesn’t pass their inspection. Another issue with Carvana is that the number you’re quoted online may not be what you receive. If the inspector deems the car to be in a different condition than which factored into the initial online quote, the value could go up or (more likely) down.

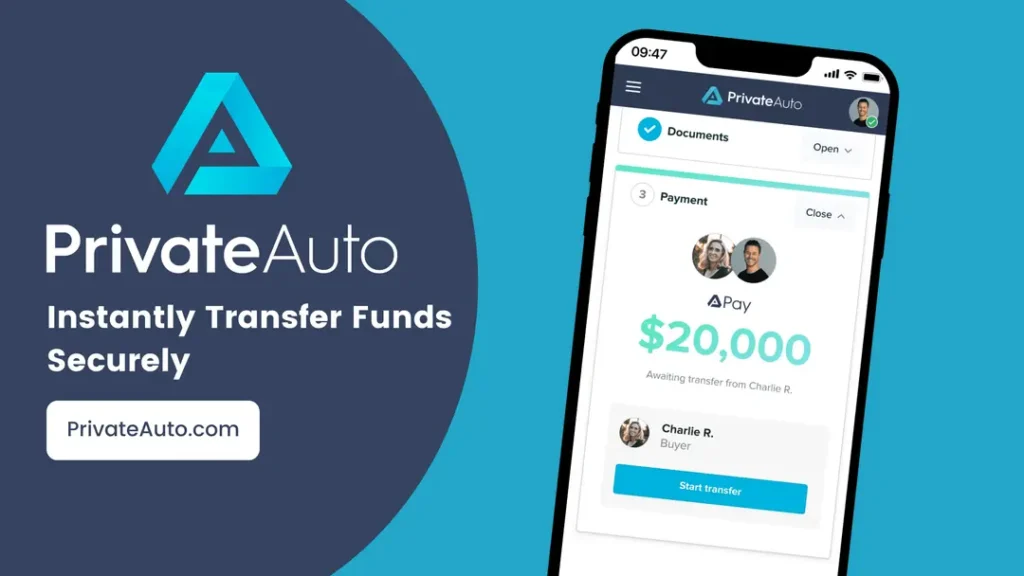

Interested in selling your car without the hassle? Try PrivateAuto.