The transfer of title protects you and the buyer from liabilities and complications down the road. You want to get it right. Fortunately, it’s pretty straightforward—if you know what to do.

Title Transfer Overview

A car title transfer happens in two parts:

- You meet the buyer, sign the bill of sale, get paid for the car, and sign the title.

- The new owner (buyer) takes the signed title and completes the transfer with the DMV (or equivalent motor vehicle registry agency; titles can vary by state) to make it official. At that time, they will also register the car in their name, pay any sales taxes owed, and get new license plates.

This article will cover the first part: how to actually sign over the physical Certificate of Title. To learn more about the second part, read our complete guide to the title transfer process.

Steps For Signing Over a Car Title

As the seller, your part of the process has 6 main steps:

- Locate your title

- Meet the buyer for a test drive

- Sign the bill of sale

- Get paid

- Sign over the title

- Take off license plates (except CA and MN)

Release of Liability

Cancel or transfer insurance

Locate your title or apply for a duplicate

One: Locate The Current Title Or Apply For a Duplicate

You can’t sign over your car’s title if you don’t have it in your possession. It’s not enough to know you have it “somewhere”; you need it in your hands in order to complete the sale.

Whether you’ve filed it away in a folder or placed it in that box of important papers somewhere in your garage, dig it out well in advance and have it handy.

If you can’t find it, give yourself time to get a replacement title. Here’s how:

- Contact your state’s DMV (or equivalent agency). You can visit in person, call, or apply online (most DMVs have an online replacement title process).

- There is typically a small fee of around $25 to get a duplicate title.

- You’ll need to provide your ID, VIN, current registration, and possibly an odometer disclosure statement with the current mileage.

- After submitting the application, the DMV will mail you a new title, typically within 2 weeks.

Meet the buyer for a test drive

Two: Meet the Buyer for a Test Drive

It’s time to schedule the test drive. Other listing sites force you to endure lots of messaging back and forth to get the test drive nailed down. In the process, you’d be sharing your contact info with a stranger. It’s time for a better and safer way.

PrivateAuto’s handy in-app scheduler streamlines the process and keeps your personal information private.

- You specify the location and set your availability.

- The buyer selects from your available time slots and schedules the test drive, with no input needed from you.

- You meet up and get the deal done.

You control the entire process securely through your PrivateAuto dashboard. You can opt to deal with only verified buyers, so you can feel confident meeting them for a test drive.

Sign the bill of sale

Three: Sign the Bill of Sale

Many states require a bill of sale for a private-party vehicle transaction.

Whether or not your state requires it, a bill of sale is a brilliant idea. It protects you in case the buyer ever wants to contest the sale or any of the specifics of the sale. It memorializes the VIN, selling price, vehicle mileage, and other key details—and it has the buyer’s signature.

Many sellers worry about whether to sign the bill of sale before or after the buyer pays them. You should sign it before getting paid, and with PrivateAuto, you can do so with confidence. Our process protects both parties in an orchestrated, step-by-step workflow.

Here’s how it plays out:

- Inspect the car together, and then both you and the buyer electronically sign the bill of sale in our mobile app

- Both of you get notified that the other party has signed the bill of sale

- Buyer is notified to release payment, and feels confident doing so, given that you have signed a legally binding document

- Payment immediately appears in your PrivateAuto Pay account

- You confirm payment, then sign the title over to the buyer

No delays. We make it easy to get paid quickly with legal protections in place. Selling a car privately doesn’t have to be nerve-wracking.

Get paid

Four: Get Paid

This is sort of the whole point of selling your car: you want money for it. Easier said than done. Before PrivateAuto, there weren’t a lot of great ways to receive payment. Each of the following has significant drawbacks:

- Cash: inconvenient and risky

- Check: inconvenient and slow

- Bank transfer: inconvenient and slow, with fees

- Peer-to-peer payment apps like Venmo or Paypal: transaction limits, sometimes fees

- Zelle: transaction limits, exchange of contact information

A Better Way to Get Paid

We got tired of clunky and unsafe money exchanges, so we created PrivateAuto Pay. It’s our FDIC-insured integrated banking solution, and it’s the only payment method in the world that meets the following criteria:

- Good for any transaction amount up to $1M

- Instantaneous

- Secure

- Keeps your sensitive info private

- Verified funds so you avoid tire-kickers

PrivateAuto Pay is so awesome that we wanted to make it available to you even if you’re selling your car on another platform such as Facebook Marketplace or Craigslist. Enter DealNow.

DealNow is the fast-track solution that bypasses the listing process and allows you to invite a buyer directly to a private deal room where you can close the deal with our transactional infrastructure. Experience the awesomeness and start a DealNow!

Don’t Sign the Title Until You Have the Funds

Don’t sign over the title you’ve been paid in full for your car. Once you’ve signed the title and given it to the other party, they are the legal owner—whether they’ve paid you or not.

It’s not enough that they pay you; you have to actually verify that you’ve received the money.

- If they give you a stack of cash, you need to count it and verify that it’s authentic (counterfeiting is fairly rare, but it does happen).

- If they give you a cashier’s check, you should go to the buyer’s bank and have the bank verify funds.

- If they initiate a bank wire, don’t sign the title until funds have hit your account.

With PrivateAuto Pay, you can verify receipt of funds immediately after the buyer releases them. This eliminates friction from the transaction process and lets you get the deal done in one smooth session.

Sign the title

Five: Sign The Title

This is the actual part where you transfer the title to the buyer. Both of you will need to fill out the physical Certificate of Title for it to be valid, and both of you will sign it.

Some states will require the signing to be notarized. If you live in such a state, you’ll need to meet the buyer at a notary public—or arrange for a notary to meet you at the test drive location.

Always keep the following information in mind while filling out the certificate of title:

- Write neatly.

- Never use nicknames.

- Never use white-out or erase anything.

- Any spelling mistakes void the document, so don’t misspell anything.

- Only use blue or black ink. Any other color ink will void the title.

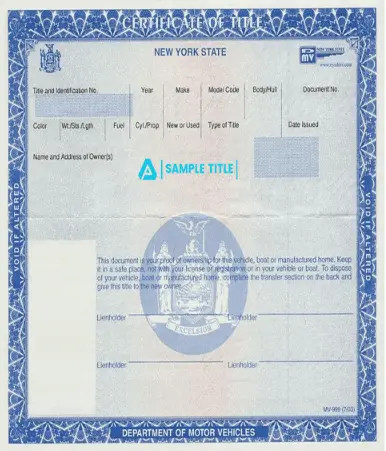

Here’s a New York title; your state’s title format might be slightly different.

The front of a New York title is for the lienholder. If the car doesn’t have a loan, the front remains blank.

Some states have the lienholder section on the back of the title.

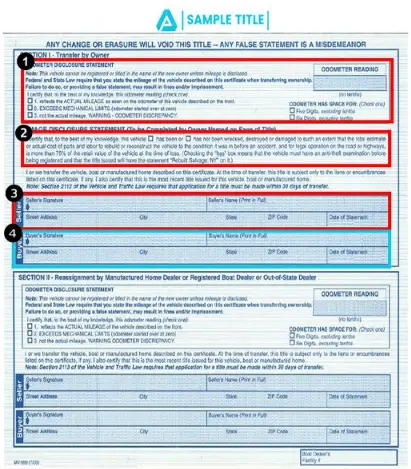

On the back side of a New York title, you will enter the following:

- Exact odometer reading

- Check the box if the car has been in a wreck (most states don’t have this section)

- Your full name in printed letters and a signature

Your state may have different sections or may have them positioned on the front of the title instead of on the back (or vice versa). Some states require more inputs, such as the car’s sale price, make, model, and year.

Take the time to carefully read your title. For state-specific instructions, click on the link for your state below.

Both you and the buyer should double-check the vehicle identification number and compare it with that listed on the title. If you wind up with the wrong VIN listed on the title from a clerical error, you’ll face a serious hassle to get it rectified.

Take off the plates

Six: Take Off Your Plates

In 48 out of 50 states, you must remove your license plates when selling your car.

California and Minnesota are the exceptions—they allow plates to stay with the vehicle when ownership transfers.

Detach your plates after the sale is completed, before the buyer drives away with the car. Keep them to put on your next car (if your state allows), or turn them in to the DMV. Check your state’s rules for what to do with old license plates to be sure you’re following protocol.

When you remove your plates before handing over the car you are ensuring don’t receive tickets or violations on a vehicle you no longer own.

Required documents

What Documents Do I Need to Sell My Car?

You can’t sell your car without the proper documentation. Different states have different requirements, but here are some of the most common documents you’ll need.

- Certificate of title (of course)

- Bill of sale (required by some states, recommended for all)

- Odometer disclosure

Certain states have additional requirements, including but not limited to, insurance coverage, vehicle history reports, and a damage disclosure form.

Release of liability

Release of Liability

Some states require you to file a release of liability with the DMV after you sell your car privately. Others don’t. Whether or not your state requires it, a release of liability is a good idea. It notifies your state that you no longer own the vehicle and protects you from legal and financial liability for the car after the transfer. It releases you from responsibility if the vehicle is damaged or involved in an accident after you close the sale.

Cancel or transfer insurance

Should I Cancel or Transfer My Insurance?

When you sell your car, your insurance policy doesn’t pass on to the seller. For one, you don’t want them on your policy. For another, your insurance company won’t allow it.

You have two options for your sold car’s policy:

- Cancel the policy completely. This allows shopping for a brand-new policy suited to your next car. However, you lose continuity of coverage and your policy history. Cancellation fees may also apply.

- Transfer the policy to your new vehicle. This maintains uninterrupted coverage and your insurance record. It also lets you adjust coverage to fit your new car’s specifics. Transferring avoids potential cancellation costs.

Transferring insurance is usually the best option if you want to preserve continuous protection and your policy longevity. But canceling works if you want to change providers or coverage. Check cancellation policies and consult your insurer about the best choice when selling one car and getting another.

Your buyer will get their own insurance policy on the vehicle.

How to Sell Your Car on PrivateAuto

PrivateAuto is the best place to sell your car because we offer tools that make private sales easy and secure. No other listing site offers the full transactionality that we do. Here’s how our process works.

- Create an account on PrivateAuto.

- List your car for sale with our easy, step-by-step guided process.

- Set your pricing and terms and screen would-be buyers.

- Vet incoming offers and choose a buyer.

- Meet the buyer for a test drive.

- You and the buyer e-sign documents from your PrivateAuto mobile app.

- Get paid instantly.

So easy.

Looking to buy a car? Shop used cars for sale by owner and find the ride of your dreams today!

Car Title FAQ

What happens if the buyer doesn't complete the title transfer within 10 days?

In most states, car buyers have 10 days to transfer a car’s title into their name. If they don’t, they may face some consequences

Your state’s DMV could put a hold on their registration if they delay beyond 10 days, which means they wouldn’t be able to get new license plates or tags until you transfer the title.

Additionally, if the buyer gets pulled over, the police may give them a ticket for driving an unregistered vehicle. So while it’s important to make sure they transfer the title within the allotted time frame, it is not your problem.

Can I just sign a car title to someone?

When you sell a car, you need to sign the title over to the buyer. This transfer of ownership is what allows the new owner to register the vehicle in their name and obtain insurance.

Signing over a car title is a pretty straightforward process, but there are a few things you’ll need to keep in mind.

First, make sure that the person you’re signing the title over to is qualified to drive the car. If they’re not, then they won’t be able to register the car in their name.

Second, you’ll need to make sure that the title is free and clear of any liens or encumbrances. If there are still payments owed on the car, then you’ll need to arrange for those to be paid off before you sign the title over.

Finally, be sure to have all of the necessary paperwork including the bill of sale and odometer reading in order before you sign anything. Once everything is in order, simply sign your name on the dotted line and hand over the keys.

Can you transfer the title of a financed car?

When you finance a car, the lender holds the title until the loan is paid in full. This is to protect their investment in case you default on the loan and they need to repossess the vehicle.

Once you’ve paid off the loan, the lender will send you the title with their name removed and your name added as the sole owner.

If you’re selling the car before it’s paid off, you’ll need to transfer the title to the new owner and add them as a lienholder. This can be done through your local DMV office. You’ll need to provide the new owner’s information, as well as proof of insurance and payment for any applicable fees.

Once everything is processed, the DMV will send you and the new owner the updated title.

What is a transfer of ownership form?

A transfer of ownership form is a legal document that is used to transfer the ownership of property from one person to another. The form must be signed by both the seller and the buyer, and it must be notarized by a Notary Public. The date of the transfer, the owner names and addresses of the parties involved, a description of the property being transferred, and the signatures of witnesses must also be listed on the title.

In some cases, the form may also need to be registered with the state or local government. A transfer of ownership form is a simple way to ensure that the property is transferred legally and without any problems.

How to protect yourself when selling a car privately?

To protect yourself when selling a car privately, we recommend the following practices:

- Don’t give out your contact information

- Verify that the buyer has the funds to purchase the vehicle

- Deal with verified buyers only

- Receive payment through PrivateAuto Pay

How to sign over a title if the vehicle owner is deceased?

If the owner of a vehicle is deceased, the title can be signed over to the surviving spouse or another family member to release ownership—or transferred to a new buyer. The process begins with obtaining a death certificate from the county courthouse where the death occurred. Once you have the death certificate, you can take it to your local DMV office and fill out a form to have the title transferred.

Family members of deceased owners will need to provide proof of relationship to the deceased, such as a marriage certificate. If you are not the surviving spouse, you may need to provide a power of attorney form that permits you to take possession of the vehicle. Once the form is complete, you will be able to take possession of the vehicle.

After the title is transferred from the deceased, the newly titled owner may need to pay a registration fee, depending on the state. It will be important to get the vehicle registered under the new owner as soon as possible.

Helpful Links

How To Sell Your Car In Every State

Landon Epperly

Contributing Author

Landon Epperly is the Product Manager at PrivateAuto, where he thrives on turning innovative ideas into reality. With a deep passion for cars and boats, Landon combines his love for vehicles with his expertise in product development to enhance the online marketplace experience….